In general, a lower deductible means you'll be paying even more for your insurance policy premiums. This is due to the fact that your insurer will need to pay even more in the event of a crash. If you decide for a higher deductible, your insurance premiums tend to be reduced. Think about just how much you want to pay out of pocket in the occasion of an accident.

Make sure you maintain extensive coverage in mind if you drive any one of these commonly stolen cars and trucks and also vehicles. Insurance Deductible Exceptions, Fortunately, there are some circumstances in which you do not have to pay your insurance deductible. These scenarios are necessary to remember when you're calculating the suitable actions to take after a crash.

This is the finest program of activity regardless of that's at-fault for the accident. When you're associated with a crash that's not your fault, you ought to still file the insurance claim with your very own insurer. Your insurance firm is always mosting likely to wish to pay the least amount of cash feasible, so if they discover you're not responsible, they will certainly go after repayment from the other vehicle driver's insurer.

Simply bear in mind that you'll only have your insurance deductible covered for you if your insurance company is able to obtain coverage for the entire expense of the damages from the other insurance firm. With these consider mind, you can find a deductible for your plan that best fits your driving needs from a carrier like Progressive.

This content is produced and kept by a third event, as well as imported onto this web page to assist customers supply their e-mail addresses. You may be able to locate more information concerning this as well as similar material at.

Some Ideas on What Is Car Insurance Deductible 2022? How Does It Works? You Should Know

Allow's claim you just got in an accident as well as your cars and truck needs $4,000 out of commission, yet your insurance will just cover $3,000. If you're puzzled, recognizing your auto insurance deductible may be the response - suvs. In this post, we'll clarify what an automobile insurance coverage deductible actually is, when you require to pay it, and whether you need to pick a high or reduced one.

You don't actually pay a deductible to the insurance provider you pay it to the service center when they repair your vehicle. Depending upon your state, you might have an insurance deductible for various other kinds of insurance coverage, also. Allow's say you submit a claim that results in a $2,000 expense. If you have a $500 insurance deductible, you have to pay that quantity prior to the insurance business pays the remaining $1,500.

Insurance companies will certainly not be accountable for expenses that do not surpass your deductible. cars. Your cars and truck insurance deductible doesn't work like your medical insurance deductible. With health insurance, you have an insurance deductible that obtains reset each year. As you make use of health and wellness solutions, the money you invest out of your very own pocket will build up.

With automobile insurance coverage, you pay your deductible every time you submit an insurance claim. affordable car insurance. On your way to the repair service shop, a freak hailstorm storm includes more damage to your car.

There is no limitation to how many times you pay your insurance deductible in a year. If you submit 5 different crash claims in one year, you'll pay your deductible 5 times. cheaper cars.

The How To Choose The Best Car Insurance Deductible - Jerry Diaries

vehicle insurance risks insurance affordable low cost

vehicle insurance risks insurance affordable low cost

If you live in a location with constant negative climate, you could want to pick a reduced extensive deductible to restrict what you pay out of pocket. At the exact same time, you can maintain your accident insurance deductible higher to balance out your automobile insurance policy premium.

In that case, your vehicle insurance coverage costs would certainly cost even more to offset the $0 vehicle insurance coverage deductible. When Do You Pay An Auto Insurance Policy Deductible? Right here are the main circumstances in which you 'd be in charge of paying an insurance deductible: If you create an auto accident and your auto needs repair services, you'll pay your insurance deductible on your collision protection.

Just how To Choose A Car Insurance Policy Deductible Since you understand what an auto insurance coverage deductible is, it is crucial to choose the appropriate deductible for your scenario (laws). You should select a high cars and truck insurance deductible if you desire to lower your regular monthly expense and also if you have the ability to pay it.

If you do not have any type of financial savings, it's not a smart concept to have a high insurance deductible. You may be the most effective driver worldwide, however you still share the road with bad drivers and also without insurance motorists (insurance companies). According to the Insurance Info Institute, regarding 6 percent of chauffeurs that had collision coverage submitted a case in 2018.

You can constantly select a lower insurance deductible while you conserve up an emergency fund and after that raise the insurance deductible later on. You need to choose a reduced automobile insurance deductible if you do not have the ability to pay a high one, or if you wish to secure your out-of-pocket expenses. A low insurance deductible might be a good suggestion if you reside in a congested area where you have a greater opportunity of experiencing a mishap.

See This Report about How To Choose Your Auto Insurance Deductibles - Rates.ca

Some programs will certainly reset your insurance deductible to the complete amount after you make a claim, as well as others will reset it to a smaller sized amount. After five years, you would have paid an additional $100 or even more to your insurance policy company.

What Happens If You Can Not Pay Your Deductible? If you are incapable to pay the rest of your costs for the deductible, you may have some alternatives.

cheapest car cars suvs auto

cheapest car cars suvs auto

Knowing when to change your insurance deductible and when to search for a brand-new vehicle insurer with economical rates is the safest way to prevent high expenses in the future. Our Suggestions For Automobile Insurance Policy Searching for automobile insurance policy doesn't need to be hard. Simply see to it to get quotes from several carriers, so you can compare prices.

What is accident coverage? Collision insurance coverage assists pay for the cost of fixings to your automobile if it's hit by an additional lorry - suvs.

That indicates it would not spend for damage to an additional person's lorry or property. Accident also does not cover all damages to your vehicle. Examples of problems not covered are: Burglary Vandalism Floods Fire Striking an animal If you wish to know more about protection for these type of damages, look into the detailed coverage web page.

The 3-Minute Rule for Controlling The Cost Of Auto Insurance - Nj.gov

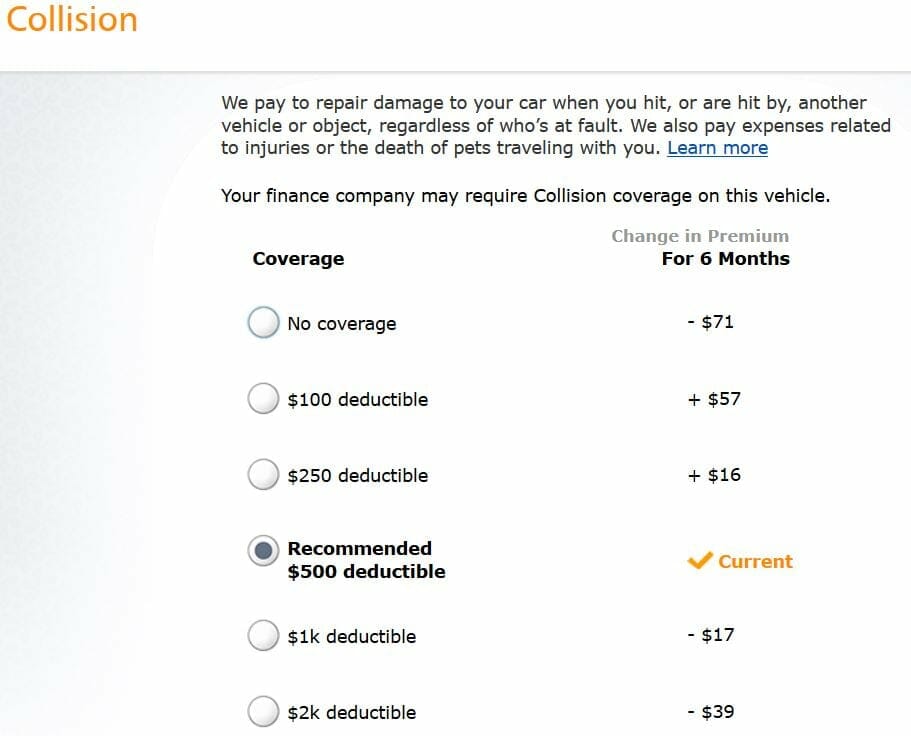

What is a crash insurance deductible? A collision insurance deductible is the quantity you've accepted pay prior to the insurance company starts paying for problems. You can think about it as just how much of the financial risk you're eager to handle if you remain in a crash. Generally, the even more risk you want to take (greater deductible), the reduced your insurance coverage expense would certainly be (cheap).

Allow's claim you're associated with a crash that triggers $1,000 in damages to your lorry as well as you have a $250 insurance deductible on your collision insurance coverage. You'll pay the first $250 in damages, typically to the body shop, and after that your insurance will pay the remaining $750 - cheap. The above is implied as general information and as basic plan descriptions to aid you comprehend the various sorts of coverages.

We are so pleased you asked! This is a crucial concern one that lots of people respond to as soon as and also never quit to revisit as their situations transform. What is an insurance deductible? An insurance policy deductible is the quantity of money you need to pay from your own pocket prior to your insurance protection begins - cheap auto insurance.

accident low cost auto vehicle insurance car

accident low cost auto vehicle insurance car

Raising it from $500 to $1,000 might yield a 14 percent financial savings (insurance company). Again, these are simply price quotes.

car vehicle insurance cheap insurance accident

car vehicle insurance cheap insurance accident

And also if you don't have to sue for 2, 3, or 4 years you might save a substantial amount of money gradually. (FYI: the ordinary auto proprietor drives for 8. 3 years without submitting a case. SUV as well as pickup vehicle proprietors have insurance claims about every 6. 5 years).

The Best Strategy To Use For What Should My Insurance Deductible Be?

There are a couple of points to think about when choosing your deductibles, such as your spending plan, the value of your vehicle, just how much you have in financial savings that you could place toward car repairs as well as the probability that you'll require to make a case (insurers). Example, If you have an older car with reasonably reduced worth, you may wish to choose a high insurance deductible in order to keep your premiums reduced.

In basic, the higher the insurance deductible, the reduced your premium costs for an insurance plan. Vehicle insurance coverage deductibles are typically paid per case, so you will certainly have to pay your deductible amount out every time you make a thorough case.

What is a comprehensive insurance deductible? An extensive insurance deductible is the amount of money that you are responsible for paying towards an insured loss. The quantity of the deductible is deducted from your claim payment in case of a protected crash. Commonly, comprehensive deductibles vary from, as auto insurance deductible choices vary depending upon your state legislations and also insurance provider standards (car insurance).

Why you may not desire a high comprehensive deductible? A high insurance deductible can mean that you need to pay more out of pocket in the event of a mishap or other covered loss. This can be particularly troublesome if you do not have a lot of savings or reserve to cover these expenses.

Consequently, you might not be able to obtain the total of coverage you require if you have a high insurance deductible. Having a greater insurance deductible makes it harder to get certain price cuts. Several insurance business use price cuts for low-mileage motorists. If you have a high insurance deductible, you might not be able to get these discounts.

How To Choose Your Car Insurance Deductible (2022 Guide) Fundamentals Explained

One of the most your insurance policy will payment is the auto's actual cash value what the vehicle was worth on the market before the damages occurred minus your picked insurance deductible amount (vehicle insurance). You can bargain the real cash worth of your cars and truck in the occasion of a total loss by providing different instances of comparable cars and trucks.

Extensive insurance cases as well as your rates, The majority of states' insurance coverage guidelines call for that extensive claims be covered by the policy. The price increase is typically moderate since detailed insurance claims are not connected to the insurance policy holder's driving.

Comprehending the Automobile Insurance Deductible Insurance Coverage, News, Net

Your automobile insurance coverage deductible is the quantity of cash you would certainly contribute when your insurance coverage company pays for a covered claim. Exactly how do cars and truck insurance policy deductibles function?

Anytime you remain in a cars and truck accident as well as there are damages to your automobile that would certainly be covered under thorough or collision coverages, you'll be in charge of paying the insurance deductible under each of those insurance coverages. You can choose various deductibles within your automobile insurance coverage plan for both accident as well as extensive. If you have numerous cars and trucks on your vehicle insurance plan, you can also select different deductibles for each and every vehicle.

The Definitive Guide to What Does Deductible Mean In Car Insurance?

You can select different coverage restrictions for all of them, Take a look at the site here in addition to established deductibles, depending upon which insurance coverage it is - prices. Why can not you always pick your deductible? Since not all insurance coverages have them and some, like Injury Security, have them in some states, as well as not others. Job with your insurance provider to determine exactly how to fulfill your insurance coverage needs.

In short, a higher deductible amounts to lower insurance policy costs. A reduced deductible equals higher insurance premiums.

When selecting car insurance policy coverage, you picked the low deductible of $500 (cheaper cars). What if you chose a high deductible of $2,500? They have much less threat, so you'll pay a reduced premium.

This can be risky company What happens if like in the example above, you picked a $2,500 deductible yet really did not have that cash money available? When you submit an insurance policy case, you'll be invoiced for your deductible. If you don't have that $2,500 ready to pay out you might be embeded a bind with a service center.